The story sounds like a plot in the vein of The Full Monty or Kinky Boots. A struggling Michigan toys and collectible figurines company, headed up by a goodhearted businessman Richard Berry, is trying to keep the business afloat and the workers employed in a time of high unemployment. Berry hardly has a prayer until he discovers that he has in his possession the credit card information for Peter Jackson, the highly-successful film director behind the Lord of the Rings trilogy. Berry starts using the card to make business purchases and plans to pay it off once his luck changes, but he winds up charging $190,000 by the time he is caught.

The story sounds like a plot in the vein of The Full Monty or Kinky Boots. A struggling Michigan toys and collectible figurines company, headed up by a goodhearted businessman Richard Berry, is trying to keep the business afloat and the workers employed in a time of high unemployment. Berry hardly has a prayer until he discovers that he has in his possession the credit card information for Peter Jackson, the highly-successful film director behind the Lord of the Rings trilogy. Berry starts using the card to make business purchases and plans to pay it off once his luck changes, but he winds up charging $190,000 by the time he is caught. Credit card theft is not funny and should not be encouraged under any circumstances. Still, I couldn't help but feel for Richard Berry. In an interview with Macomb Daily, Berry feared what might happen to his employees if his business failed, explaining, “So many people were relying on me and the thought of failure and letting all these people down weighed heavily on me that I made some very foolish and terrible decisions.” He was desperate, and while he admits that his actions were wrong, he is working hard to make things right. Already, he has paid American Express for more than half the money he fraudulently charged and is continuing to pay off the rest. He is hoping that his willingness  to cooperate will convince the judge to let him serve his 18 month sentence in a half-way house or under house arrest.

to cooperate will convince the judge to let him serve his 18 month sentence in a half-way house or under house arrest.

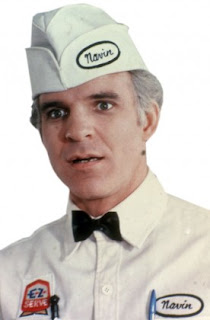

For having the most epic credit card theft story I have heard in months, I am giving Richard Berry the Navin R. Johnson award. I applaud your compassion for your employees, but seriously, did you think you could get away with using Peter Jackson's credit card?

If you are having financial difficulties or have been the victim of identity theft, call My Credit Specialist at 1-866-565-6500, or go to http://www.mycreditspecialist.com to sign up for a free credit evaluation.